Even after you’ve created your fix-and-flip business plan and work schedule—unexpected events, changes, and delays can still happen. So, you need a good exit strategy to pull yourself out of the gutter and save what you can of your investment.

For many, the flipping business is a lucrative real estate investment strategy to earn your profits more quickly. But, the reality is that there are many variables beyond your control that can drastically change your estimates. Even so, these obstacles shouldn’t automatically mean defeat.

By having exit strategies ready, your fix-and-flip project will be prepared for any unexpected challenges that pop up. As Benjamin Franklin once said, an ounce of prevention is worth a pound of cure.

The 7 Best House Flipper Exit Strategies

Like with any business plan, an exit strategy is an essential part of your project. The main goal is to minimize losses and maximize profits—even when things don’t go according to plan. Use any of these 7 exit strategies below for a solid plan B.

Short-Term Exit Strategies

Sometimes you just don’t have enough time and you need to make decisions fast. In cases where time is an important consideration, here are some short-term real estate exit strategies to help you keep things going.

Lower Your Price

A good exit strategy is to lower your price. Of course, you don’t want to go too low or you’ll lose money on your investment.

This is why many real estate investors use the 70% rule to be confident they’re buying a property that is reasonable to flip. This rule of thumb means you won’t pay any more than 70% of the After-Repair Value of the property minus the value of renovations. To get the ARV, simply add the property’s current value with the value of renovations.

For example, if a property has a value of $100,000 and needs $20,000 in repairs, then its ARV is $120,000. After, calculate 70% of ARV ($120,000 × .7 = $84,000) then subtract the value of renovations ($20,000). According to the 70% rule, you should pay around $64,000 for the property. Your expected profit will be the ARV minus the value from applying the 70% rule ($120,000 – $64,000 = $56,000)

This gives you enough wiggle room in your budget for unexpected costs and the potential to lower your price without eating too much into your profits.

Now, the percentage you lower will also depend on the receptivity of the market. Sometimes dropping your price by just 5% can do the trick. But other times, you might have to go lower. Whatever the percentage necessary, lowering your price can save the sale and allow you to still make a profit.

Wholetailing

Wholetailing is uncommon, but another possible exit strategy. It’s similar to wholesaling, except you cover the repairs and renovations necessary to make the house livable. Think of it as a combination of fix-and-flip and wholesaling.

Like in wholesaling, you first purchase a property’s contract. After that, you perform a fix-and-flip and cover all the necessary repairs and renovations, such as the property’s structure, appearance, electrical wiring, and plumbing. Once the property is in livable condition, it’s ready for a buyer.

Not sure if wholetailing is for you? Here’s a list of things that make a property eligible for the strategy:

- The property has to be clean and clear of any infestations such as mold, termites, and so on.

- Essentials such as plumbing and electrical wiring have to be functional.

- The structure has no major issues and fixtures are in good condition—as in no broken stairs, holes in ceilings and walls, broken floors, etc.

In addition, you can put up wholetail properties on the Multiple Listing Service (MLS). As a minor version of a fix-and-flip, flippers can consider wholetailing as another source of income. Diversifying your income options can help you generate an income in case your flipping strategy tanks.

Breakeven

Sometimes, the best exit strategy is the one that avoids any loss. In this case, you simply sell the property at the price you obtained it in order to minimize loss. It’s not ideal, but the silver lining is that breaking even will at least cover any debts, repairs, and renovations.

Long-Term Exit Strategies

For those with fewer financial and time constraints, you can opt for long-term real estate exit strategies. These options are for those who aren’t in urgent need to replenish their finances.

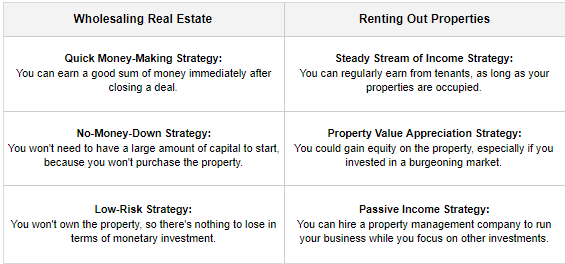

So, another good exit strategy is to convert your fix-and-flip project into another real estate investing business. Tapping into another market and going for different types of deals can increase your chances of turning your investment around.

Hold Out

When the market runs dry, sometimes you’re left with no other options than to hold on to the property. In this exit strategy, investors can hold onto the property until a profitable offer comes along. This exit strategy goes against the nature of a house flipping business, but if you can afford to wait, a delayed sale may be worth it.

There are also a few notable ways the buy and hold strategy earns money:

- Capital Gains. If you invest in the right market, the property value increases with time. Delays in the sale could also mean higher profits if the market heats up.

- Equity Gains. In contrast to capital gains, this refers to the amount of property that you actually own as opposed to the amount you have financed.

Rent Out Short-Term

Whether it’s listing your property on Airbnb or specifically offering your own private short-term rentals, you can make roughly 2-3 times more renting your flip out short-term, compared to long-term. You’ll have to be prepared to manage your short-term rental and spend a lot of time dealing with guests, however, unless you’re going to work with a property management company.

That being said, it’s also a great strategy if you just want to rent your flip out for a short period and then sell it later on (like when market conditions improve).

Rent Out Long Term

The business of property rentals has peaked in the past 50 years, with more and more renters looking for places to live. If your project is fixed up and ready to be lived in, then you can choose to rent it out as your exit strategy.

By renting, you can generate income on the property and help your finances recover. If the rental continues for extended periods, it can also pay for itself and generate passive income in the future.

Offer Seller Financing

For buyers on a tight budget and flippers eager to find a buyer, seller financing is a good exit strategy that can help both parties. With this option, the seller acts as a lender to the buyer. You can negotiate almost any terms you want: purchase price, down payment, interest rate, term length, when a payoff is due (also called the balloon period), etc. In Michigan, a land contract is typically used, but you can also offer an actual mortgage. In either case, you’ll need a very experienced attorney to walk you through all the legalities.

Apart from the benefits, it provides buyers, there are also several benefits for sellers. Some notable benefits are monthly income, an increase in ROI from interest, and spreading tax liability for a few years. Nevertheless, be mindful there are also disadvantages that come with seller financing. For example, you may have to deal with the buyer’s inability to pay, taxes, title searches, and so on.

Conclusion

Even a well-laid-out plan isn’t full proof. Sometimes, there are factors beyond your control that can affect your house flipping business. But just because it’s not going as planned doesn’t mean there isn’t an opportunity for profit.

A great business plan accounts for bumps in the road. With a good exit strategy, you can maneuver through your obstacles and get the best possible outcome. Consider these exit strategies to continue your flipping endeavors with confidence. Then, you will still have options to save your investments—just in case.

Did we miss anything? Let us know in the comments below!