We get it. It’s scary to get into real estate investing, especially if it’s to flip a home.

Countless shows have “proved” flipping to be easy, but the reality is much more challenging. As a house flipper, how much money should you spend on the renovation? How fast do you have to complete it?

And, most importantly, how can you flip a house legally?

Well, you must know eight legal risks when doing house flips. You may be in trouble if these aren’t handled properly, so we’ve outlined the most crucial house-flipping legal risks below.

Risk #1: FHA Re-Selling Restrictions

The Federal Housing Administration (FHA) is the largest mortgage insurer worldwide and gives mortgage insurance for loans made by approved lenders. Unfortunately, the FHA also places several restrictions on its mortgages, which limit how often a home can be bought or resold.

For example, known as the “anti-flipping rule,” you must wait at least 90 days before selling or flipping an FHA-financed home. Moreover, any resale between 91 and 180 days where the new property price exceeds its previous price by more than 100% will need more documentation for the FHA.

Risk #2: Building Codes and Zoning Regulations

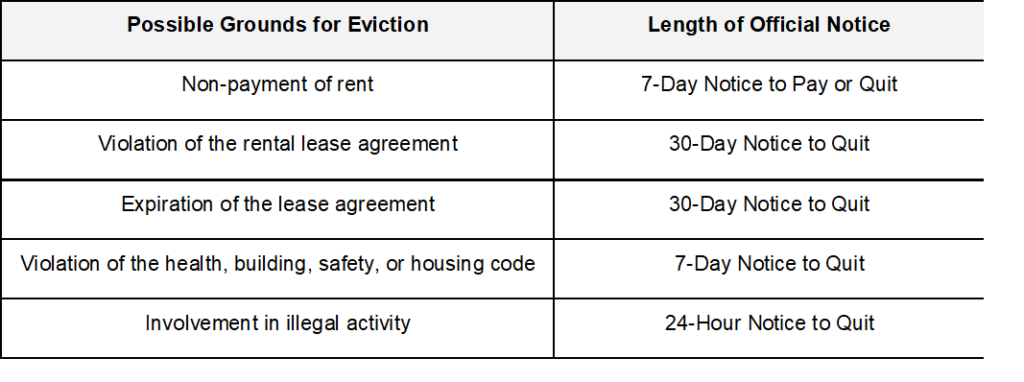

Ensure that the property you buy complies with all local building codes and zoning regulations. Failure to do so can result in costly fines for both the buyer and the seller. So, take your time researching local laws to stay updated with any changes in any area before flipping a house.

Risk #3: Right of Rescission Rules

Be aware of any “right of rescission” rules that may apply in your jurisdiction when transferring property from one party to another. These legalities can vary by state, but they provide rights and protections if a homeowner wishes to back out of an agreement within three days of signing the contract.

Risk #4: Real Estate Contracts and Disclosure Statements

It goes without saying (rather, we wish it could) that you should understand the contract that you’re signing when purchasing a property. Read through the entire thing carefully and ask questions if there are any items that aren’t clear.

What novice flippers might miss, however, are the disclosure statements that must be included in real estate transactions, like lead-based paint disclosures or radon gas disclosures. Not complying with these regulations can result in fines and lawsuits against your flipping business, so always double-check.

Risk #5: Financing Fraud

Document everything thoroughly when financing a flip project. You’ll want to do this because lenders are tightening up, most notably regarding mortgage fraud and loan misrepresentation.

Refrain from misleading them about your financial situation to secure financing for a property, as failure to disclose all necessary information can lead to serious legal repercussions. And once again, fully understand the terms and conditions of any loan you take out.

Risk #6: Fair Housing Laws

Fair housing laws protect buyers from discrimination based on race, religion, gender, or nationality. As a flipper, you must abide by these laws and never discriminate against potential buyers when marketing your flipped home. If found in violation of this law, you risk heavy fines and even jail time.

Violations include, for example, sending out a direct mail advertisement for a home featuring only families with young children and not mentioning any other age groups or demographics—it’s considered discrimination.

Risk #7: Mortgage Loan Fraud

Chances are, you don’t have enough cash on hand to purchase your property. So, you’ll likely involve banks and lenders to finance your project.

Lending can become a cycle: you take out a mortgage to purchase the home, the next buyer acquires their own mortgage to buy the home from you, and so on. That cycle becomes ripe for mortgage loan fraud, where the buyer misrepresents their financial situation to get a larger loan.

To avoid fraud, request proof of income and other documents when dealing with buyers. You can also use third-party services that review potential buyers’ credit scores and verify their employment history before they purchase the home from you. These practices will help protect you from any fraudulent activities.

Risk #8: Issues With the Property Title

You may notice a lot of affordable properties in the market to flip for a significant profit. But between lenders, borrowers, real estate agents, and more, it can be challenging to know who owns the property you’re looking to flip—who can legally sell it to you.

So, before you acquire any property, ensure that you have title insurance to verify the title’s status on your behalf, and do your due diligence before making any major decisions. As much as possible, you should avoid dealing with fraudulent titles or legal disputes that could arise from a previous owner.

House Flipping With No Legal Repercussions

House flipping can be an incredibly lucrative business venture. By understanding these legal risks upfront, you’ll be in a much better position to have a large profit margin when entering this endeavor.

Just remember: consult with a local attorney if you have questions or concerns prior to doing any real estate transaction. Ensure that everything is done in accordance with all applicable laws and regulations to truly (and surely) build your house-flipping empire .

Do you need more help in house flipping? Join as a member, subscribe to our newsletter, and attend our upcoming meeting to stay updated with the market. You’re only as strong as those around you!