Though most of us have pets that we love more than our children, you may be hesitant to allow pets into your precious rental properties. It’s understandable—but do the benefits outweigh the risks?

Pet owners are everywhere, especially here in the US. According to the American Pet Products Association’s National Pet Owners Survey, there are approximately 65.1 million households that own at least one dog, while 46.5 million households own cats.

As a landlord, allowing pets in rental units can be difficult. On the one hand, there are pet-owners out there who will only rent properties that allow pets—they consider their furry friends a family member. But on the other hand, pets can cause property damage and create noise disturbances for other tenants (especially if it’s within an apartment building or multi-family complex).

In this article, we give you a low-down on the risks and benefits of allowing pets and include info on protecting your property while avoiding liability.

The Risks and Benefits of Allowing Renters with Pets

The majority of renters own pets, and businesses outside of real estate are capitalizing on the trend by catering to pets and their owners. For example, brands like Starbucks are offering pet-friendly products and experiences, promoting a positive attitude among pet owners.

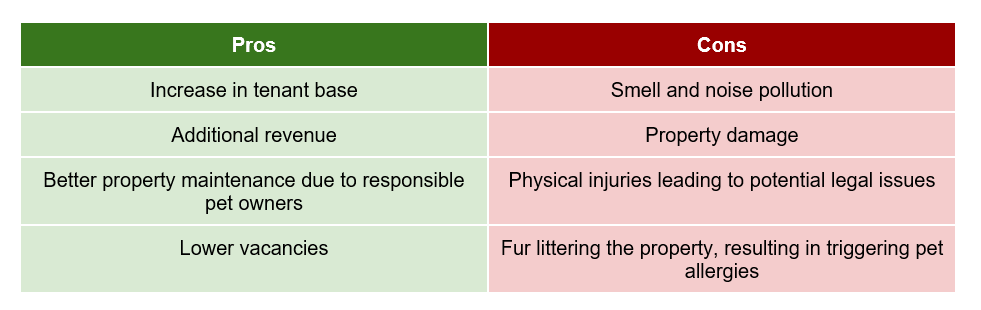

Like any business, landlords pet owners are a lucrative market to tap into.If you consider allowing pets into your property you run into an equal amount of benefits and issues:

Be vigilant with your pet and tenant screening, and you’ll reap the benefits and mitigate risks. Here’s how.

Decide and Inform What You’ll Allow

It’s crucial to be clear about what is and isn’t allowed when it comes to pets in your rental property. That’s why it’s a good idea to include pet requirements in your lease agreement, as well as a pet addendum.

The pet addendum should outline specific rules and regulations related to pets. It should include:

- The number of pets allowed

- The types of animals permitted on the property

The addendum should also include clauses that protect you as a landlord:

- Allowing you to remove aggressive or dangerous pets while allowing the tenant to remain

- Revising pet rules with 30 days’ notice, and outlining penalties for violating pet-related rules

What to Pet Rules to Include

When creating your pet addendum, consider the following:

- Common pets in your area

- Potential damage each pet could cause

You can then include specific requirements in your lease agreement and pet addendum to address these concerns. For example, you may want to limit the number of pets each tenant can bring and exclude larger dogs or exotic pets.

To protect yourself as a landlord, include key clauses in the lease explaining the agreement for responding to problems concerning pets. These clauses should clearly outline the procedures for dealing with pet-related issues and any potential consequences for tenants who violate the rules.

By including a pet addendum in your lease agreement, you can ensure that both you and your tenants are on the same page regarding the expectations and guidelines surrounding pets in your rental property.

Get Insurance and Follow the Law

Before allowing tenants with pets, check your insurance policy for any limitations, exclusions, or coverage requirements. These regulations will vary from one state to another.

For instance, Michigan landlords must also comply with state pet laws, such as requiring pet vaccinations and enforcing proper pet waste disposal. Landlords should also ensure responsible adult supervision of pets in common areas. Visit the Michigan government website for a complete list of pet laws.

Follow Fair Housing Laws

Be mindful that a Fair Housing Law protects disabled people who need animals for their emotional well-being and physical safety. The term “disabled” now includes the blind, paralyzed, those with clinical depression, and those with post-traumatic stress.

You can request a note from their physician to verify their condition and animal assistance requirements to keep things documented.

Charge Higher Fees for Pet Owners

Landlords can charge pet-owning renters a premium in three ways due to the additional risks involved in allowing pets into the property. Here are the three:

- The first is a pet deposit, which is refundable and ranges from $100-$300, collected at the beginning of the lease to protect the property from damages related to owning a pet.

- The second is a nonrefundable pet fee, collected at the start of the lease, usually 25% of the first month’s rent, acting as compensation for the property damage risks resulting from allowing pets.

- The third is a “Pet Rent,” a monthly fee for keeping a pet on top of the rental price that ranges from $25-$50/month.

Screen the Tenant and Pet

Conduct thorough screenings that include feedback from references and past landlords. During interviews, landlords should ask about the pet’s vaccinations, licensing, and past behavior.

Clear expectations for pet owners should be outlined in the lease agreement, including requirements for keeping shots, licenses, and tags up to date, registering the pet with the landlord, and taking responsibility for any harm caused by the pet.

Also observe physical and behavioral characteristics of the pet, such as aggression or friendliness, interaction with the owner, and whether the pet is spayed or neutered. By taking these factors into consideration, you can make informed decisions about whether to allow pets in their rental units.

More Tenants and Extra Income: Consider Allowing Pets

With nearly 90 million households owning a pet, it’s safe to say American love their fuzzy friends. So, ignoring that fact might lead to lost profits if you’re a property owner. As long as you follow our tips above and be careful with your contracts, allowing pets into your properties only has upsides.

Learn more about your rights as a landlord over tenants’ pets, reach out to us today to connect with our team of experts. Join REIA and subscribe to our newsletter to get the latest news in real estate.