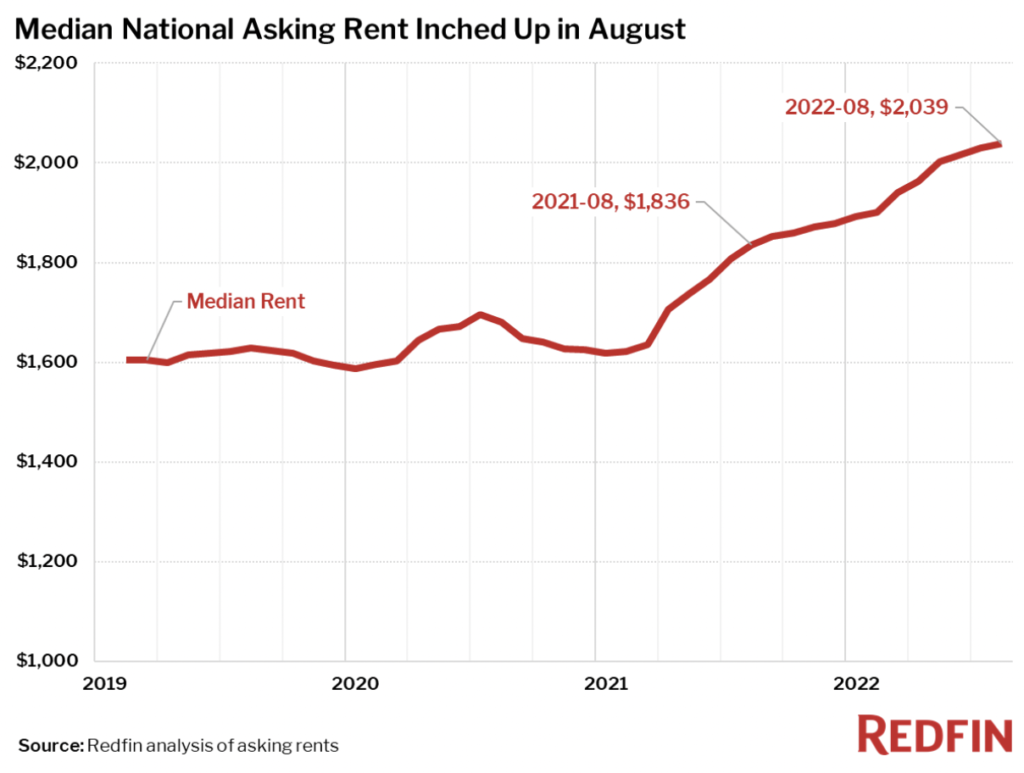

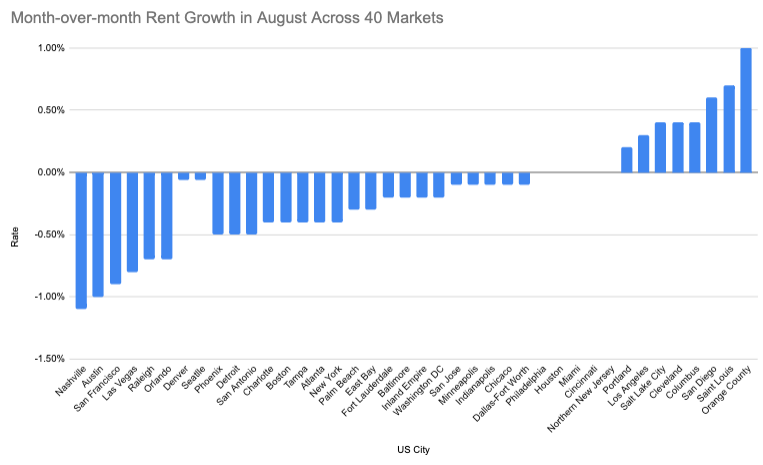

In times when rental markets are skyrocketing, landlords can still profit from their rental property by listing it on Airbnb as an alternative to long-term tenancies.

Converting your long-term rental property into a short-term rental (STR) can offer exciting revenue growth opportunities.

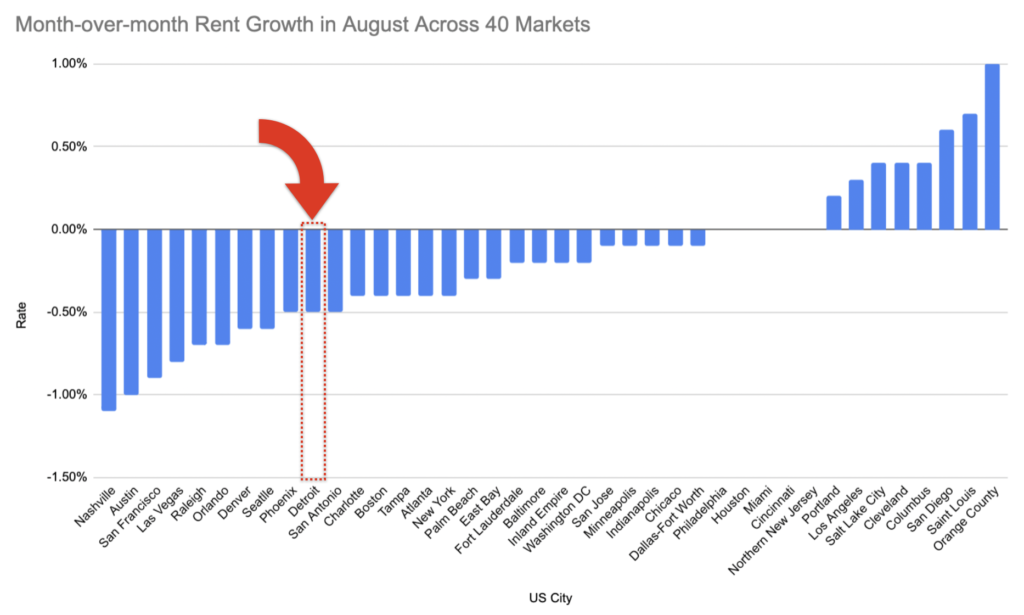

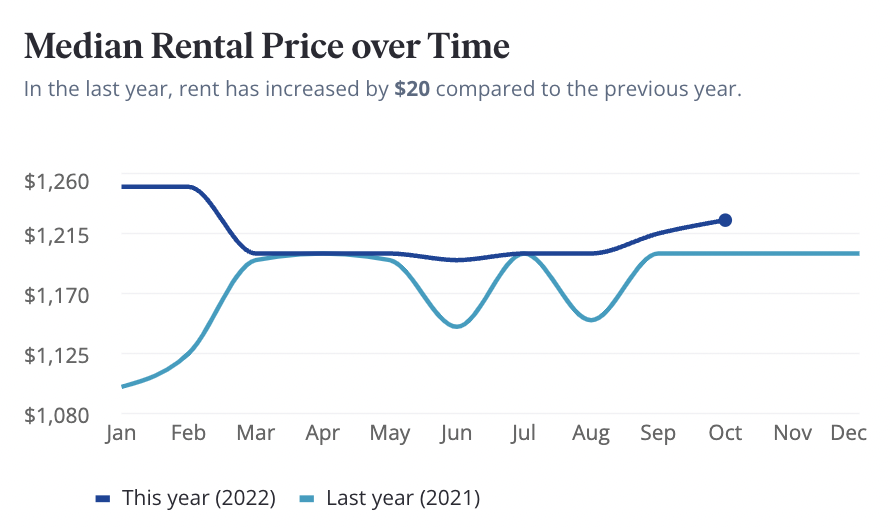

For example, a single-bedroom apartment renting for $1,395 in downtown Detroit can fetch $110 to $150 per night as an Airbnb listing. That’s a 200% to 300% bump, assuming it has a high occupancy rate. STRs can generate higher income, because they charge a premium for flexibility and convenience.

But before taking the plunge and converting, it’s important to consider some key factors to ensure you’re making a smart investment decision that aligns with your goals and maximizes your returns.

Here are five things to take note of before switching your rental into an Airbnb.

1. Local Laws and Regulations

When you consider converting your rental unit into an Airbnb, the first step is to familiarize yourself with the local laws and regulations, including tax implications. Different states have specific rules governing short-term rentals, and you don’t want to find yourself on the wrong side of the law—that will cost you money instead of earning money.

For example, short-term rental units in the City of Detroit can only host for no more than 90 days per calendar year, while Los Angeles allows up to 120 days per calendar year.

If operating a short-term rental property in your area is illegal, it’s best to avoid it altogether.

You can learn more about the City of Detroit’s short-term rental laws and regulations here.

2. Risk Tolerance

Short-term rentals come with their own set of risks, including potential damage to your property and financial instability. Of course, a long-term tenant can accidentally burn your property as quickly as a short-term guest. That’s because they’re guests and may not treat your home with the same level of care as an owner does—even with background checks.

What’s important is that you consider how you’ll handle any damages or repairs that may arise and whether you have the financial means to cover these costs. With Airbnb Host Guarantee Program, you can get up to $1 million in protection against theft and damages, but it doesn’t protect valuables like artwork and jewelry.

You can also review your homeowner’s insurance (get one if you don’t have it yet) to see if you have the liability and damage coverage before taking in guests.

3. Net Operating Income & Cashflow

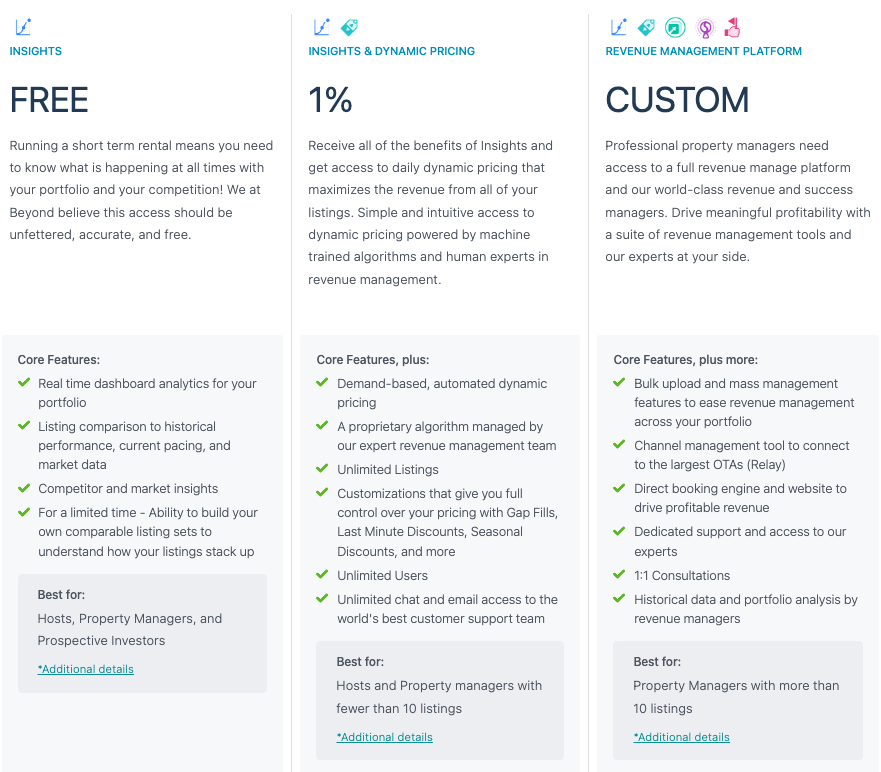

Crunch the numbers and determine whether converting to an STR will increase your property’s profitability. Consider the potential rental income you can generate, factoring in seasonal fluctuations and any expenses associated with running a vacation rental.

Here’s a simple equation to calculate your net operating income:

Gross Monthly Income – Operating Expenses = Net Operating Income (NOI)

If you determine that you’ll get a significant increase in your NOI, then we highly recommend you convert to an STR. That’s because if you have a stronger cash flow, you can reinvest your profits to grow your real estate portfolio and make more money.

Meanwhile, converting to an STR may not be worthwhile if the value is almost the same as your long-term rental income or a trivial increase.

4. Time

Another crucial aspect to consider is your time. Managing a short-term rental can be more time-intensive than a long-term rental. Consider the additional responsibilities involved, such as planning a marketing strategy for your property, handling guest inquiries, cleaning, and maintenance.

Assess whether you have the bandwidth to dedicate the necessary time. Your time is valuable, so ensure the investment aligns with your availability and lifestyle.

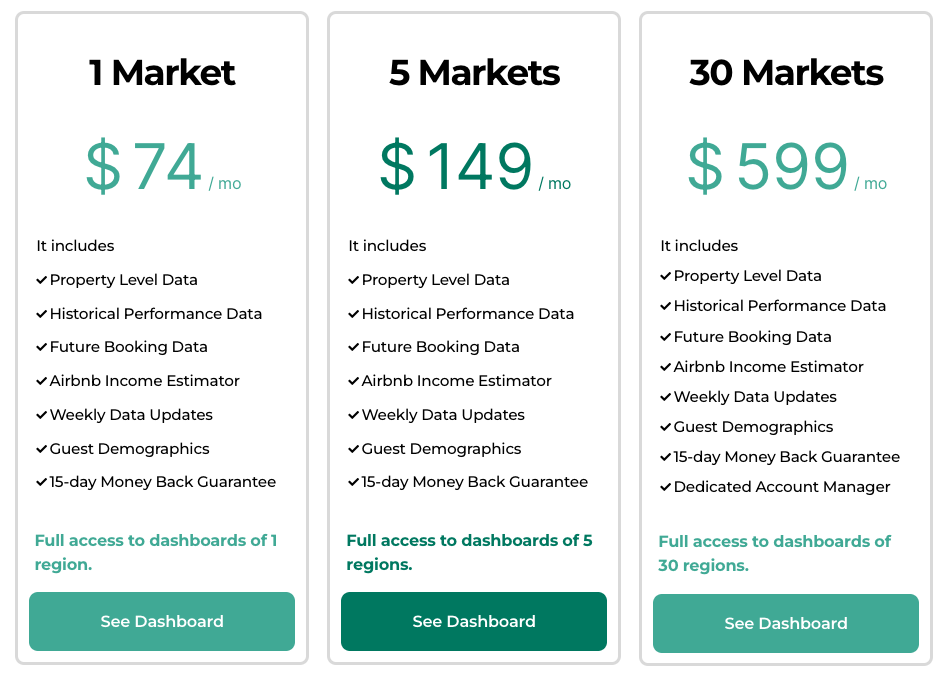

5. Management Fees

If you realize you don’t have enough time to manage an STR, you can hire a property manager to do all the heavy lifting. Short-term rental managers do more than collect rent and solve tenant problems. They also do the following on your behalf:

- Furnish your property

- Manage online presence

- Optimize pricing strategies

- Maintain cleanliness and orderliness of your property

- Ensure you have a full stock of essential supplies

Hiring property managers makes listing your properties as STR so much easier. They can alleviate some of the crucial workload of an STR, but it’s also essential to understand the associated costs and how they will impact your overall return on investment. To start, you can research multiple property management companies to compare their services and pricing structures.

Of course, you can opt out of outsourcing property managers, but be ready for the challenge of finding reliable cleaners, maintenance technicians, and other maintenance partners you’ll need.

Convert with Confidence and Embrace STR Success

Converting your long-term rental property into a short-term rental is an exciting opportunity that can bring more money into your pockets, but it’s important to proceed with caution. It’s still an investment property that inevitably comes with risks, so it requires careful consideration.

Make sure that you understand and check all the key factors mentioned above to help you make an informed investment decision that maximizes your returns.

Join a REIA of Oakland Country, MI to acquire more insights from fellow investors in Detroit.