It might have come as a shock to a lot of landlords as market conditions have drastically reversed in the past year, bringing the 20-month streak of increasing rent amounts to a halt. Unfortunately, this drop in rent prices is seen across the nation, affecting many investors’ potential returns.

So, what can you do about it to stay profitable in your real estate investment?

Let’s discuss it below.

How did rent prices decrease significantly?

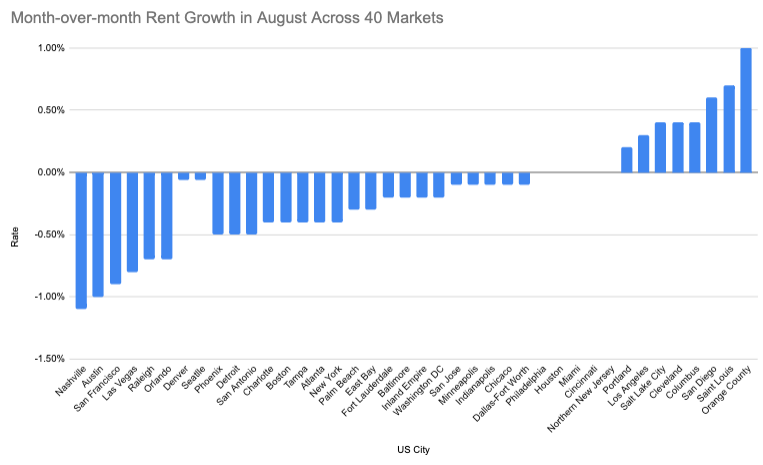

In recent months, the US real estate market slowed down, where rent decreased by 0.1% across 40 of the most extensive metropolitan areas in August 2022. Renters celebrate financial relief (excellent), but investors clutch desperately to their original investment returns (not ideal).

Here’s a snapshot of the rent price movements across 40 markets, where we see that our home area, the City of Detroit, has dropped 0.5% month-over-month:

Jay Lybik, CoStar Group’s national director of multifamily analytics, said, “We’re seeing a complete reversal of market conditions in just 12 months, going from demand significantly outstripping available units to new deliveries outpacing lackluster demand.”

Beyond that, places like the City of Detroit are experiencing a labor shortage in the construction and maintenance industry of the City of Detroit. While this news means that it’s harder to build homes (bad news for anybody developing a property), it means that the demand for housing stock is still increasing. And, more importantly, people are competing for a limited number of units (good news for landlords and rental property investors).

If you’re a rental property investor in the City of Detroit, ensure that you stay ahead of the curve and keep your properties in excellent shape to attract and keep tenants. And of course, always keep an eye on the market and prepare to adjust your rents accordingly.

What should landlords do when rent averages decline?

The most important rule in real estate investing is to stay updated with the market’s current status to change your strategy on the fly and avoid significant financial losses. For instance, if you know that there’s an oversupply of rental units in your area and not enough renters to fill those up, opt to lower your rent to attract quality tenants willing to pay for a comfortable space.

But if you think that the rent prices in your area will continue to decline, selling your property might be the best move to make. This tip is especially true if you’re carrying a lot of debt—the last thing you want is to end up upside down on your mortgage.

Of course, there are other strategies that you can do to stay profitable during a rent price decline. Here are 4 tips to maintain financial viability:

#1 – Review your financials and make necessary changes

Go over your finances and see where you can make adjustments. This might mean looking for ways to reduce expenses, like cutting down on maintenance and marketing costs. You should also consider ways to increase your income, such as by finding new tenants or increasing rent for existing ones. If you have vacant units, consider offering discounts or incentives to attract new renters.

#2 – Negotiate with your lenders

This could involve asking for a lower interest rate on your mortgage or a longer repayment period. You might also want to consider refinancing your loan so you can get more favorable terms. This could help you free up some extra cash each month that you can use to cover other expenses.

#3 – Raise rent for existing tenants

If you can, consider raising the current rent amount for your existing tenants. Doing so could help offset any decline in rent prices that you’re experiencing. Of course, you must be careful not to price your tenants out, so raise your rent slowly to keep occupancy up without dragging your returns down.

#4 – Diversify your portfolio

Diversifying your portfolio means investing in other types of property, like commercial or vacation rentals. Doing so could help you mitigate some of the risks that you’re facing with your rental properties and generate additional income to cover your expenses.

Rent Drops Doesn’t Always Mean Cash Flow Decrease

The biggest takeaway from all of these is that landlords should always be updated with the latest market trends so they can change their strategy accordingly. This way, they’ll be able to protect their investment and even grow their portfolio despite a rent drop.

No matter what strategy you use, stay proactive and adapt to the changing market conditions. By doing so, you can minimize the financial impact of a rent price decline and keep your business healthy.

One way to stay updated is by signing up as a REIA member. You can also subscribe to our newsletter and join our upcoming meetings, so you’ll be the first to know any tips or advice we have regarding the real estate market. The market is always changing, so you have to as well.